American beer exports have seen considerable growth in recent years. This is largely driven by the macro breweries and classic American beer brands such as Budweiser and Miller, despite their much-documented domestic sales stagnation.

The craft beer boom has offered Americans more choice in beer styles than ever before. There are more small, independent breweries than there have been for 150 years. This has lead to the diversification of beer within the domestic market. Macro breweries have tried a number of tactics to keep up, from joining the trend, to acquiring smaller breweries and their craft beer brands, to reclaiming the word ‘macro’, and still the result has been declining domestic sales.

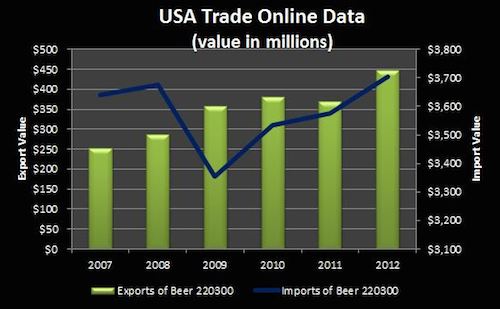

However, at the same time as American beer fans are looking for something new, so are global beer drinkers. Beer fans in growing markets like China and Brazil are becoming more exposed to iconic American macro beers like Budweiser. The U.S. Census Bureau shared the graph below last week, showing just how much those markets have changed in recent years.

American Beer Exports vs Foreign Beer Imports

American beer exports (the green bars in the chart) have risen in value from $251.4 million in 2007, to $448.4 million in 2012 (the latest year with data). That is a staggering increase of 78 percent over five years.

The love is not completely mutual: imports of foreign beers to the US did grow, but from $3.6 billion in 2007 to $3.7 billion in 2012 – much less that the boom in exported beer.

This increase in global market share has certainly helped balance the books of AB InBev and the like, helping to nullify some of the losses, and poor marketing and product choices in the US domestic beer market.

Perhaps American beer will have a dominant global brand the same way that their soda or burger counterparts have done? More time, and data, will tell.

by Lee Jarvis.