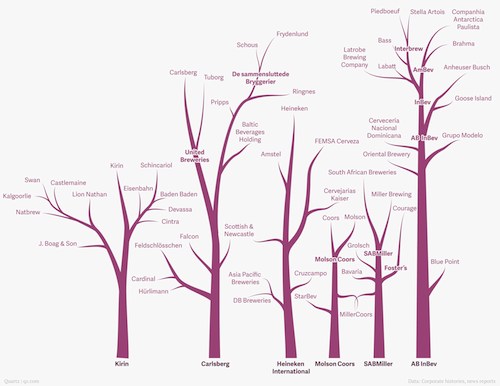

This family tree of beer companies was recently created by Quartz. It shows how six large multinational breweries own, operate, and oversee dozens of smaller brands in their portfolios. In 2013, these six companies accounted for over 50% of beer sales by volume.

click to view full size ‘Beer Family Tree’ image

The owning of smaller brands by larger multinationals is nothing new. These corporate entities were mostly formed via a series of mergers throughout the 1970s as several regional breweries closed, and the 1980s saw economies of scale developed, huge advertising budgets unleashed, and yet more consolidation. The collection of beer brands for the big six above shows no sign of slowing down; currently, ABInbev is looking at acquiring SABMiller, and SABMiller themselves recently approached Heineken with an acquisition proposal (which they later declined).

As these companies continue to merge, they will continue to become more instrumental in the global beer industry. As more brands get picked up, more volume is attributed back to these larger holdings companies; in 2013 the 10 largest brewers produced 65% of all beer sold worldwide.

As of yet, the growth of their market share, however, has not been detrimental to smaller craft breweries. As released earlier this year, the growth of craft beer continued through 2013. A notable figure from that report: craft brewers reached 7.8 percent volume of the total U.S. beer market, up from 6.5 percent in 2012.

Beer Mergers

There is however, a resurgence of interest by breweries of all sizes in scooping up craft beer brands and planting their own beer family tree. Back in 2009, then 23rd largest US craft brewer Long Trail Brewing purchased smaller craft brewery Otter Creek Brewing. 2010 saw Anderson Valley Brewing sold to HMB Holdings and then Anchor Brewing sold to investment and consulting company The Griffin Group. In 2011 AB InBev bought Chicago’s Goose Island for close to $39 million, and then the major brewer struck again in 2014 when it acquired Long Island-based Blue Point Brewing. The Belgian Brewery Duvel Moortgat has picked up Brewery Ommegang, De Koninck Brewery and Missouri’s Boulevard Brewing Company all within the last decade.

Not all craft breweries are for sale though, and some craft beer brewers are steadfast in their aim to sail the journey solo. Bell’s Brewery founder Larry Bell is unequivocal about craft beer mergers, constantly turning down meetings from bankers and private equity firms. California-based Stone Brewing Co.‘s co-founder Greg Koch has been a vocal opponent of any sales or mergers, and instead, the 10th-largest U.S. craft brewer went about raising funds in order to develop their own East coast operation in Richmond, VA. Fellow Californians Lagunitas Brewing Company let their actions speak when they announced a second brew house in Chicago, to complement their West coast operations.

It seems like the consolidation of breweries will continue each time a new ‘local hero’ of craft beer makes it big and wants to reach a wider audience. After all, who doesn’t want their beer to be popular and enjoyed by people around the world? The ready-made distribution pipelines and production facility expansion possibilities are tempting alone.

How will the beer family tree grow in 2014? Share your thoughts in the comments below.

by Lee Jarvis.